Quick Market Update!

![]()

The Blue Angels just left town after an amazing Seafair weekend, and summer is flying by! I hope you are enjoying some sunshine along with time with family and friends. The July 2022 Eastside stats are out, and I wanted to share some notes and graphs.

-

- We are still seeing an increase in active inventory, but at a slower pace than the previous two months. Price decreases have also slowed down and the median price is up 6.72% from a year ago ($1,330,563 in July 2021 vs $1,420,000 in July 2022).

- In July 23% of listings sold in an average of 7 days on market and a median difference of 4% over list price. For comparison, in July of 2021 73% sold for more than list price.

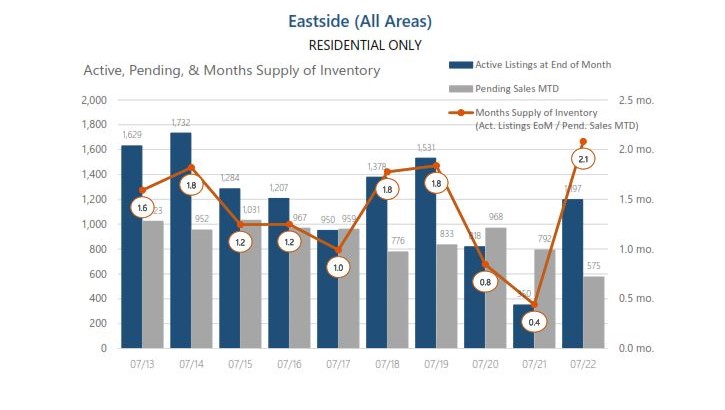

- Active inventory in July grew by 847 houses (350 listed on 7/31/2021 & 1,197 listed on 7/31/22).

- The market is much more balanced between buyer and seller. In some areas and price ranges sellers are competing (as compared to buyers competing)

- Year to date in 2022 there has been 1,160 fewer closed sales (3,603 YTD) vs 2021 (4,763 YTD). The buyers are certainly out there, but many are sitting on the sidelines watching prices and interest rates. Buyers are also traveling more than the last two summers and distracted by sunny weather and social gatherings. Real estate is always quieter in July and August as compared to the Spring market.

- Interest rates have decreased from their peak of 5.81% the week ending June 23rd to 4.99% the week ending August 4th.

- The median closed sales price dropped from $1,500,000 to $1,420,000 from June 2022 to July 2022. That being said, this does not necessarily mean that a $1,500,000 home has decreased in value to $1,420,000 in one month. The median closed sale price is influenced by price decreases and the product mix that is selling (and a smaller number of sales). Lower priced homes are making up a bigger percentage of the overall number of sales than a year ago, which lowers the median closed sale price.

- Buyers have many more choices! The last time that the Eastside had over 1,200 listings (2 months supply) was back in 2019.

- Contingencies – It is more likely that a seller will accept an offer from a buyer that is contingent on an inspection, financing, appraisal, etc.

- Marry the Property, and Date the Rate! It is possible that today’s buyers will be able to refinance to a lower interest rate in the future, reducing their monthly cost.

- I would not be surprised if 2023 kicks off with low supply, high demand, and many multiple offer situations. The current market conditions were caused by rapid price appreciation and interest rate increases. However, the Puget Sound’s underlying lack of supply and huge demand has not changed, and rates have improved.

- No one can predict the future with certainty! Buyers should always be comfortable with the payments and location, and plan on living in the house for the foreseeable future

As always, please consider me as a resource for your real estate questions. I am also happy to send stats for your particular around

the Puget Sound.

PS: You can also consider me as a resource if you are looking for a sunny, second home or investment property in Florida. Visit www.DonWeintraubFlorida.com

FEATURED LISTING

500 106th Ave NE Unit #2905, Bellevue WA, 98004 – $1,999,000

Sleek urban design in this end-unit feat. 2 bed + den/office, 2 balconies, & a wall of windows on 3 sides showcasing enviable views of mts. & the city! Chef’s kitchen w/ brand new quartz countertops, Viking 6 burner cooktop & oven, & custom walk-in pantry. Fresh new wall paint and newer matte wood floors. Relax in the master suite w/ a walk-in closet, add. closet for storage, & more views. 2nd en-suite bedroom w/ views & full bath. 2 parking spaces + storage unit. Walk to shopping, restaurants, Amazon, waterfront park and all the best of Bellevue. Amenities include spa, gym, concierge, theater, 1/2 acre garden & new lobby! LEED Gold rating for sustainability.

Click to view my Latest Video!